Johnson & Johnson Looks To Blood Cancer Drug Successor With Early-Stage Deal

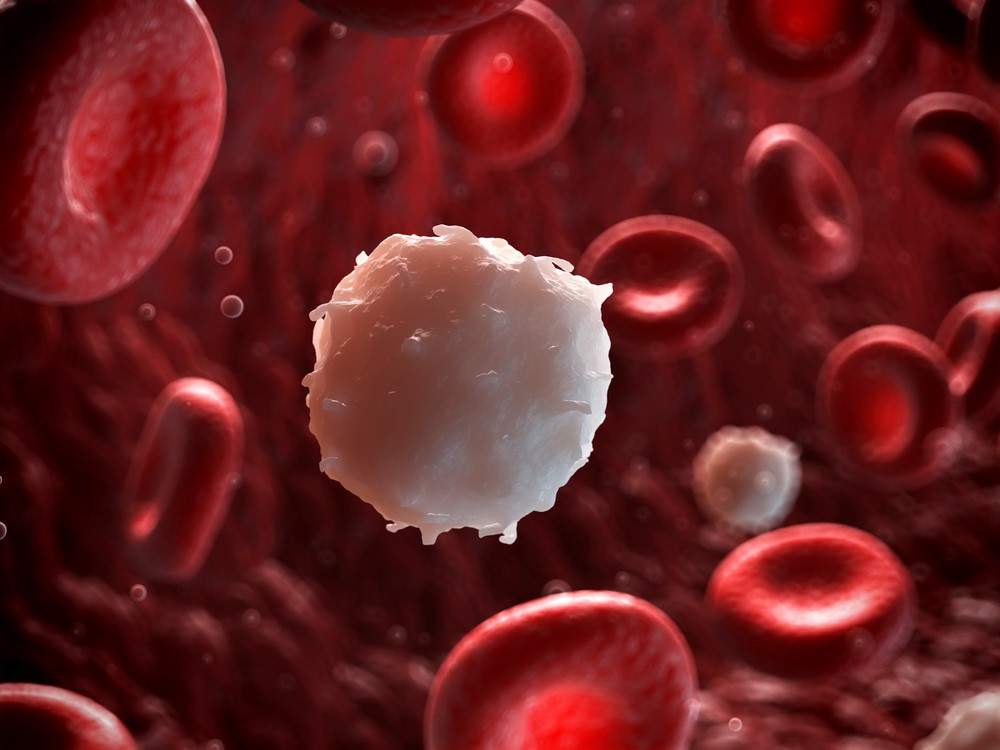

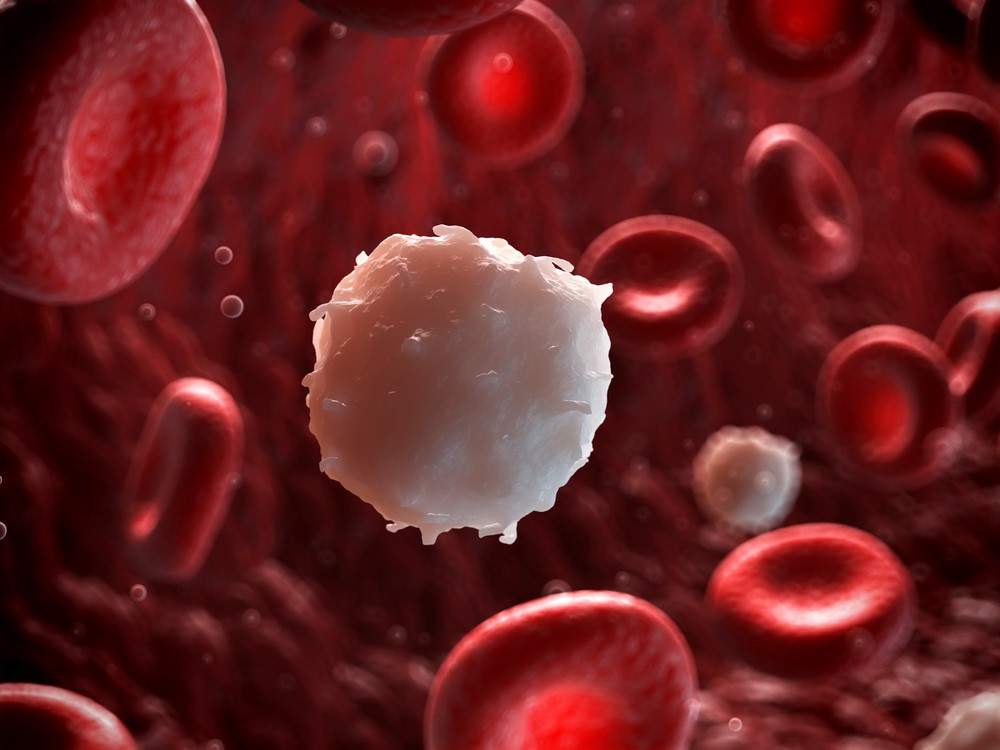

Johnson & Johnson team up once more with Genmab to carry a potential successor to Darzalex known as HexaBody-CD38. The reasoning for developing HexaBody-CD38 is to not handiest move after multiple myeloma but additionally be used for plenty of other types of symptoms inclusive of other sorts of most cancers. Darzalex is a top-promoting drug generating as much as $2.02 billion in sales in 2018, and the expectancy to in all likelihood earn $3 billion in 2019. The overall payout quantity from Johnson & Johnson to Genmab for the partnership may want to emerge as over $1.1 billion while all is stated and finished with all milestone payments. Looking for a portfolio of ideas like this one? Members of Biotech Analysis Central get unique get entry to our version portfolio.

Johnson & Johnson (JNJ) teamed up again with Genmab to produce any other most cancers drug. This might be a drug that could be a successor to Darzalex, which has become developed to treat sufferers with more than one myeloma. This is a superb deal to try to hold the blockbuster alive for treating sufferers with this sort of most cancers. The drawback is that this is an early-level program, so it will take some time to get it via to the hospital. On the flip facet, it has the capacity to turn out to be a blockbuster in the coming years.

A Deal With Reduced Risk

Johnson & Johnson had struck an address Genmab yet again. This time across the wish to get every other product from pre-clinical paintings all of the manners as much as capability approvals in multiple territories. The deal is about a subsequent-era CD38 monoclonal antibody that utilizes a tech called HexaBody. The aim is to have Genmab start the partnership via organizing more than one evidence of idea research to prove that the drug works. These evidence of concept studies will be for more than one myeloma (MM) and diffuse huge B-cellular lymphoma (DLBCL). Considering that Darzalex was developed for more than one myeloma, this next-generation drug, HexaBody-CD38, has to be a super clinical product for development. Why is that this a good buy for Johnson & Johnson? The bottom line is that it loses not anything in monetary fee until it chooses to exercise its license on worldwide rights for the drug. This is the most effective contingent upon if it chooses to do so. That means it will be able to see if Genmab comes out with sturdy evidence of concept information first earlier than you decide on whether or not it desires to flow forward. Then, if Johnson & Johnson see that the statistics are powerful, it could, in all likelihood, choose to license HexaBody-CD38. The deal made could emerge as costing Johnson & Johnson over $1.1 billion. One key item being that after 2031, there might be a tiered royalty between 13% and 20%. This is a great partnership, and I trust that there may be plenty of cost for Johnson & Johnson here. Especially since HexaBody-CD38 was capable of obtaining precise pre-medical results in multiple myeloma, lymphoma, and leukemia.

Darzalex Successor Holds Massive Potential

Darzalex is a high promoting drug, specifically because it produced $2.02 billion in income in 2018. It is even feasible that complete-yr 2019 sales could reach $three billion. It has been authorized to treat certain forms of more than one myeloma warning sign. The ability successor HexaBody-CD38 can also end up being even advanced in terms of sales. That’s because now not handiest is it being evolved for multiple myeloma, but it also goes after many different indicators. Such indications include lymphoma, leukemia, and probable other kinds of target indicators not coping with cancer. The HexaBody-CD38 monoclonal antibody has the ability for advanced potency in opposition to a directed goal. Meaning that the drug has a robust impact on the supposed cell goal. How is that completed? That’s finished when the target binding on the cell surface takes place with antibody hexamers. By having elevated potency, the aim is to have a more preferred healing impact against an extensive range of diseases. What does this suggest in phrases of a real-world utility? The bottom line is that it permits extra freedom to go after other goal indicators and is not simply restricted to a pick out few illnesses. In my opinion, the most vital reason this HexaBody platform is ideal is due to the fact it may be mixed with different antibody platforms. The variability of this type of era by being blended with other tech makes it ideal for more than one partnership later down the line.

Conclusion

Johnson & Johnson became right to paintings with Genmab once more, particularly to improve an ability successor to Darzalex. Not handiest will Darzalex be used again to deal with patients with a couple of myelomas. However, there’s the capability to make bigger improvements of the drug to different cancers warning signs and probable even against other kinds of diseases. The risk is this software is inside the early levels of development. In that manner, by the point the HexaBody-CD38 makes into the clinic, the landscape for more than one myeloma remedy may evolve towards other styles of remedy. It’s viable that remedies consisting of CAR-T or other mobile therapies may provide extra robust responses.

The accurate news is that the deal turned into located in one of this way that Johnson & Johnson can wait to look how it all performs out earlier than it chooses to license the drug. It may also turn out that it finally chooses no longer to move ahead if it feels that the landscape is exceptionally aggressive. That’s a great element as it leaves it away out simply in case matters change considerably. This article is published by Terry Chrisomalis, who runs the Biotech Analysis Central pharmaceutical service on Seeking Alpha Marketplace. If you like what you study here and would love to subscribe to, I’m presently imparting a two-week unfastened trial period for subscribers to take benefit of. My provider gives a deep-dive analysis of many pharmaceutical groups. The Biotech Analysis Central SA marketplace is $ forty-nine according to month. However, individuals who join up for the yearly plan could benefit from a 33.50% cut-price charge of $399 according to yr.