Popping too many statins to decrease cholesterol? Watch out for type-2 diabetes threat

NEW YORK:

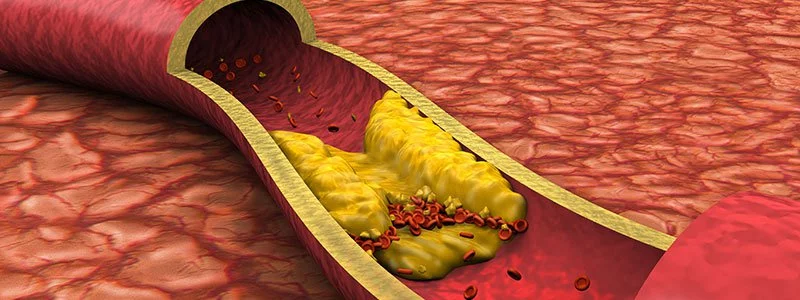

People who take cholesterol-reducing statins may be at two times the risk of developing kind-2 diabetes, says a new look at. Statins are a category that can decrease LDL cholesterol and blood pressure, decreasing the risk of coronary heart disease and stroke. More than a quarter of middle-aged and elderly adults use an LDL cholesterol-reducing drug, according to estimates. The study, published in the Diabetes Metabolism Research and Reviews journal, found that statin users had greater than double the risk of a diabetes diagnosis than people who didn’t take the drugs. Those who took the cholesterol-decreasing drugs for more than three years had more than three instances of risk of diabetes. “The fact that increased length of statin use turned into associated with an accelerated chance of diabetes – something we name a dose-dependent relationship – makes us suppose that this is possibly a causal relationship,” said the observer’s lead writer, Victoria Zigmont, a graduate student at the Ohio State University.

“Statins are potent in preventing heart attacks and strokes. I could in no way recommend that human beings prevent taking the statin they have been prescribed primarily based on this examination; however, it needs to open up further discussions approximately diabetes prevention,” Zigmont delivered. For the examination, the researchers followed over 4,000 women and men who no longer had diabetes, were applicants for statins based on coronary heart disease risk, and had no longer but taken medicine at the beginning of the take a look at. About sixteen in keeping with cent of the organization – 755 patients – had been in the end prescribed statins at the take a look of the study. Researchers additionally located that statin customers were 6.5 percent more likely to have a troublingly high HbA1c value – a typical blood test for diabetes that estimates average blood sugar over several months. “Although statins have clear benefits for appropriate sufferers, scientists a nd clinicians also have to discover the effect of statins on human metabolism, especially the interaction between lipid and carbohydrate metabolism,” said co-writer Steven Clinton, a professor at the varsity.

NEW DELHI:

India’s rural economic system is careworn, and the consumption tale is falling apart. As the boom drivers sluggish, public spending requires more attention than ever. Finance Minister Nirmala Sitharaman has a daunting mission to keep all sundry satisfied, even as sales fall short of expectations and the fiscal deficit is on edge. The Budget has usually been a system of filling one hollow by digging another. It desires to be completed smoothly, not to harm anyone, says fee investor Vijay Kedia. “Every region, be it FMCG, car, real estate, banks, or NBFC, is in a problem and wants something from the Budget. The authorities need to be looking at ways to fulfill those aspirations. But there’s little room available, and from that perspective, the Budget will be disappointing,” Kedia instructed ETMarkets.com. What are the important things that the industry expects from the primary Budget under Modi 2? Zero?

Income, company tax & MAT

Given the call for tax relief, India Inc is hoping against the desire for some tax alleviation, be it in the form of a cut in the corporate tax rate to 25 percent keeping with cent from 30 percent in liith the present for all businesses, no matter the turnover, or abolition of Minimum Alternate Tax (MAT). MAT, which is levied on organizations as consistent with Section 115JB, is calculated at 18.5 in step with cent of book profits. It draws surcharge and cess. The industry needs it delivered down to 10 in line with cent, says Jairaj Purandare, Chairman at JMP Advisors.

On the other hand, most effective organizations with a turnover of Rs 250 crore come beneath 25 in keeping with the cent corporate tax slab. “We count on a rationalization and simplification of the direct tax system, together with reasonable truth. Besides, we anticipate seeing a simplification of the GST compliance system and adoption of a 3-tier charge structure,” Purandare stated.

One segment of the industry is searching for the creation of a tax deduction related to additional investment in flowers and equipment for industries with excessive employment capacity. Care Ratings expects a remedy for aam admi, with a probable revision in profits-tax charge for those in the Rs 5-10 lakh tax slab to 15 according to cent from 20 percent at present. Nirmal Bang Institutional Equities expects some relief in the shape of a better exemption limit or the introduction of a 10 in step with cent tax bracket between the current 5 in step with cent and 20 consistent with cent slabs. At present, the exemption restriction stands at Rs 2,50,000, with a better exemption limit for senior residents at Rs 3,00,000. Incomes between Rs 2,50,000 and Rs 500,000 are taxed at five according to cent in conjunction with a rebate for those with net taxable earnings below Rs 00,000. Income between Rs 5,00,000 and Rs 10 lakh is presently taxed at 20 in step with cent. Meanwhile, there is are need to raise the limit for the highest earnings-tax charge of 30% in step with the need to be raised to Rs 20 lakh from the current restriction of Rs 10 lakh. However, the chances are low that this demand may be met.