Popping too many statins to decrease cholesterol? Watch out for type-2 diabetes threat

NEW YORK:

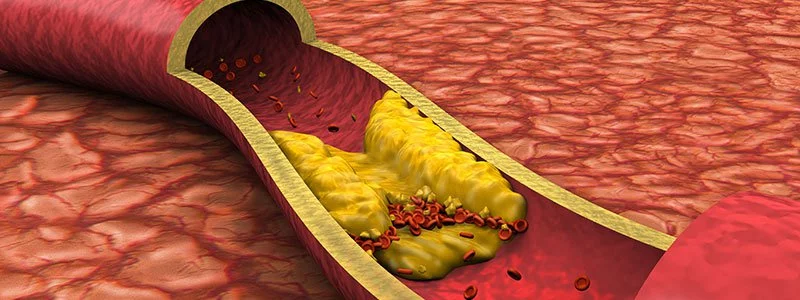

People who take cholesterol-reducing statins may be at two times the risk of developing kind-2 diabetes, says a new look at. Statins are a medicine category that can decrease LDL cholesterol and blood pressure, decreasing the risk of coronary heart assault and stroke. More than a quarter of middle-elderly adults use an LDL cholesterol-reducing drug, according to estimates. The study, published inside the Diabetes Metabolism Research and Reviews journal, located that statin customers had greater than double the danger of a diabetes prognosis than folks who didn’t take the drugs. Those who took the cholesterol-decreasing drugs for greater than years had extra than three instances of the risk of diabetes. “The fact that increased length of statin use turned into associated with an accelerated chance of diabetes – something we name a dose-dependent relationship – makes us suppose that this is possibly a causal courting,” said the observe’s lead writer Victoria Zigmont, a graduate pupil at the Ohio State University.

“Statins are potent in preventing heart assaults and strokes. I could in no way recommend that human beings prevent taking the statin they have got been prescribed primarily based on this examination; however, it needs to open up further discussions approximately diabetes prevention,” Zigmont delivered. For the examination, the researchers protected over 4,000 women and men who no longer have diabetes, were applicants for statins based on coronary heart disease danger, and had no longer but taken medicine at the beginning of the take a look at. About sixteen, in keeping with cent of the organization – 755 patients – had been in the end prescribed statins during the take a look at length. Researchers additionally located that statin customers were 6.5 percent much more likely to have a troublingly high HbA1c value – a habitual blood check for diabetes that estimates average blood sugar over numerous months. “Although statins have clear blessings, inappropriate sufferers, scientists and clinicians have to, also, discover the effect of statins on human metabolism, especially the interaction among lipid and carbohydrate metabolism,” said co-writer Steven Clinton, a professor at the varsity.

NEW DELHI:

India’s rural economic system is careworn, and the consumption tale is falling apart. As the boom drivers sluggish, public spending wishes extra attention than ever. Finance Minister Nirmala Sitharaman has a daunting mission to keep all sundry satisfied, even as sales fall quick of expectations and the fiscal deficit is on edge. The Budget has usually been a system of filling one hollow by digging some other. It desires to be completed smoothly, not to harm anyone, says fee investor Vijay Kedia. “Every region, be it FMCG, car, actual estate, banks or NBFC, is in problem and wants something from the Budget. The authorities need to be looking at ways to fulfill those aspirations. But there’s little room available, and from that perspective, the Budget will be disappointing,” Kedia instructed ETMarkets.Com. What are the important thing expectations that the industry has from the primary Budget below Modi 2.Zero?

Income, company tax & MAT

Given the call for side misery, India Inc is hoping against the desire for some tax alleviation, be it inside the shape of a cut the corporate tax price to 25 in keeping with cent from 30 in line with cent at present for all businesses no matter the turnover or abolition of reducing of Minimum Alternate Tax (MAT). MAT, which’s levied on organizations as consistent with Section 115JB, is calculated at 18.5 in step with cent of e-book profits. It draws surcharge and cess. The industry needs it delivered down to 10 in line with cent, says Jairaj Purandare, Chairman at JMP Advisors.

On the other hand, most effective organizations with a turnover of Rs 250 crore come beneath 25 in keeping with the cent corporate tax slab. “We count on a rationalization and simplification of the direct tax system together with reasonable truth. Besides, we anticipate to see a simplification of the GST compliance system and adoption of a 3-tier charge structure,” Purandare stated.

One segment of the industry is searching for the creation of a tax deduction related to additional investment in flowers and equipment for industries with excessive employment capacity. Care Ratings expects a remedy for aam admi, with a probable revision in profits-tax charge for those in the Rs 5-10 lakh tax slab to 15 according to cent from 20 at present. Nirmal Bang Institutional Equities expects some relief within the shape of a better exemption limit or the introduction of a 10 in step with cent tax bracket between the cutting-edge 5 in step with cent and 20 consistent with cent slabs. At present, the exemption restriction stands at Rs 2,50,000, with a better exemption limit for senior residents at Rs 3,00,000. Incomes among Rs 2,50,000 and Rs 500,000 are taxed at five according to cent in conjunction with a rebate for those with net taxable earnings beneath Rs five,00,000. Income among Rs 5,00,000 and Rs 10 lakh is presently taxed at 20 in step with cent. Meanwhile, there are needs that the limit for the highest earnings-tax charge of 30 in step with cent need to be raised to Rs 20 lakh from the modern restrict of Rs 10 lakh. However, the chances are low that this demand may be met.